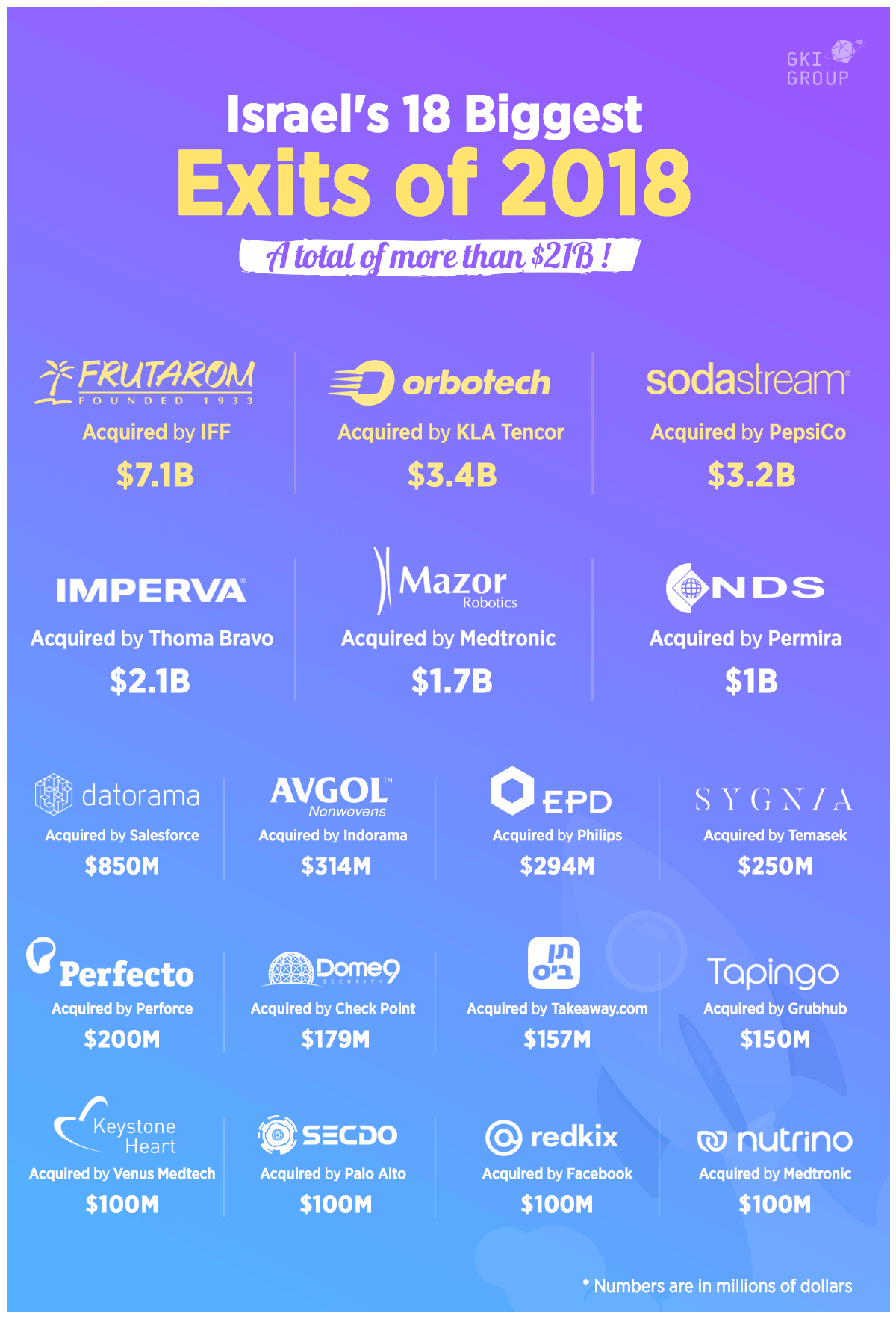

WITH DEALS WORTH BILLIONS AND HUNDREDS OF MILLIONS, THESE 18 COMPANIES FOUND A GOOD REASON TO OPEN A BOTTLE OF CHAMPAGNE WAY BEFORE NEW YEAR’S EVE.

2018 is coming to an end. Many things happened. Many startups and companies were founded, shut down, got involved in a scandal, hacked into or fulfilled their destiny – to be sold. To summarize this year, we decided to look back at Israel’s 18 biggest exits of 2018.

This year, the number of Israeli startups acquired has dropped. According to IVC-Meitar, exits in the first half of 2018 were worth a total of $6.22 billion in 58 deals, but mostly thanks to the acquisitions of Orbotech and NDS. We still don’t know the exact number of deals that took place in in the second half of 2018, but we believe that the acquisitions of Frutarom, SodaStream, Mazor Robotics and Datorama improved the statistics quite a bit.

- Frutarom

Acquired by International Flavors & Fragrances Inc for $7.1bThe biggest exit this year. Frutarom is a flavor and ingredients manufacturer that was founded a while ago, 1933, in Haifa Bay. The company creates, develops, manufactures and markets more than 10,000 raw materials and 70,000 products to 30,000 customers worldwide – ten times more than IFF, which now became the biggest flavors company in the world. With such high numbers, it’s easy to see why Frutarom is totally worth the $7.1 billion exit. - Orbotech

Acquired by KLA Tencor for $3.4b

Let’s move on from flavors to electronics. Yavneh-based Orbotech, a global supplier of solutions to almost any electronics manufacturer you can think of, was sold to California-based corporation KLA Tencor. Orbotech will remain as a standalone business in Israel, but together… they will inspect all the chips and semiconductors in the world!

In the meantime, the companies are waiting for final approval in China. - SodaStream

Acquired by PepsiCo for $3.2b

If you’re an Israeli, there’s no way you haven’t heard of this surprising merger that started to bubble in August and was completed only recently. SodaStream was initially founded in 1903 in London, but after being sold again and again and again, it finally became an Israeli company as it grew to become the world’s largest home carbonation system. SodaStream is no stranger to the headlines, for its factories in the West Bank and “scandalous” Superbowl ad starring Scarlett Johansson, but now they finally got the headline they wanted. - Imperva

Acquired by Thoma Bravo for $2.1b

Although Imperva is based in the U.S, it was founded by three Israelis back in 2002, and it employs about 500 employees in Tel Aviv and Rehovot. The cybersecurity company offering solutions to enterprises was acquired by the private equity company Thoma Bravo and will operate as a privately held company. - Mazor Robotics

Acquired by Medtronic for $1.7b Mazor

Mazor Robotics, founded in 2001, is the developer of the Renaissance Guidance System that helps surgeons perform spine surgery more accurately. After becoming the pioneers in robotic surgery and performing more than 36,000 procedures, Mazor Robotics’ acquisition also broke a local record – the biggest exit of an Israeli medical company. - NDS

Acquired by Permira for $1b

This isn’t the first time Jerusalem-based TV solutions firm NDS has been acquired. In 2012, Cisco bought it for $5b, one of the biggest deals ever made in Israel. Now, private equity fund Permira is buying it back from Cisco for only $1b. Well, TV isn’t what it used to be. - Datorama

Acquired by Salesforce for $850m

Here’s a great story of one promising startup that made its founders, investors and even employees rich. Marketing analytics platform Datorama was founded six years ago, raised a total of $50 million, and apparently left a huge impression on the CRM giant Salesforce. A bit after the news of the acquisition was made public, Datorama officially joined Salesforce’s Marketing Cloud development team. - Avgol

Acquired by Indorama for $314m

Avgol is a lightweight nonwoven fabric manufacturer, mostly used for baby diapers and other hygiene products. The company is based in Dimona and founded a long time ago, in 1953, and it’s the world’s third largest manufacturer of these materials. In May, Indorama Ventures announced buying more than 60 percent of the company’s stakes. - EPD Solutions

Acquired by Philips for $294m

Another medical success – giant multinational Royal Philips acquired EPD Solutions for €250. EPD developed the KODEX – EPD™ cardiac mapping and navigation system to help electrophysiologists navigate the heart. The company was founded only four years ago by Dr. Shlomo Ben-Haim, a serial entrepreneur who already sold some of his previous startups (Biosense, Disc-O-Tech and others) for hundreds of millions of dollars. Get us his number, we have some talking to do. - Sygnia

Acquired by Temasek for $250m

Singaporean company Temasek made a few people happy and prosperous two months ago when it announced buying the Israeli cybersecurity startup Sygnia. Sygnia operated in stealth mode with only one investment of $4.3 million from their incubator, Team8. So, yeah, Temasek turned a four million dollars investment into a $250 million deal. Way to go! - Perfecto

Acquired by Perforce for $200m

It took them 12 years and five rounds, but software testing service Perfecto, once known as Perfecto Mobile, was bought by US company Perforce. This sale is considered a disappointment since the company’s value was $380 million in 2015; however, the investors just doubled their total $90 million investment, so it’s hard to complain. - Dome9

Acquired by Check Point for $179m

This is what we truly love – an Israeli M&A. The buyer is Check Point Software Technologies, the biggest cybersecurity company in Israel. The acquired startup is Dome9, an Israeli cloud security SaaS platform that was founded eight years ago and raised a total of $29 million. Nice! - Ten Bis

Acquired by Takeaway.com for $157m

Every employee in Israel’s tech industry knows 10bis – the food ordering platform that seamlessly allows you to order food from thousands of restaurants straight to your office or home. With so much success, it is no wonder that the Amsterdam-based online food delivery company Takeaway.com agreed to pay €135m to get their hands on Ten Bis. - Tapingo

Acquired by GrubHub for $150m

Ten Bis was not the only food ordering service to be acquired this year. Nearly two months after that deal, food-ordering giant Grubhub bought the Israeli startup Tapingo. Unlike Ten Bis, Tapingo operates solely in the U.S and enables students to order food for pickup or delivery in more than 150 colleges and campuses across the country. - Keystone Heart

To be acquired by Venus Medtech for ~$100m

After Mazor Robotics and EPD, another Biomed company from Caesarea made an exit. Keystone Heart founded in 2004, developed The TriGUARD 3 ™, a cerebral protection device for patients during heart surgeries. The buyer is Chinese company Venus Medtech a developer of trans-catheter heart valves. Combining Venus Medtech’s and Keystone Heart’s technologies will make cardiac surgeries a lot safer.

[Source] - SECDO

Acquired by Palo Alto Networks for $100m

Palo Alto Networks, the American cybersecurity multinational company (founded by an Israeli), acquired a smaller cybersecurity startup – SECDO. SECDO raised $11m before the M&A, and their main investors will earn $18m from this deal. Invest in cyber. - Redkix

Acquired by Facebook for $100m

After competing with Snapchat (and beating them), Facebook is now working on a way to compete with Slack. Redkix, founded in 2014, is an email platform designed especially for teams. Facebook acquired them this July planning to add Redkix’s technology to Workplace, the “Facebook platform for Businesses.” Well, good luck. - Nutrino

Acquired by Medtronic for $100mFollowing the acquisitions of Mazor Robotics for $1.7 billion and VisionSense for $75 million (who didn’t make it to this list), Israeli medical devices company Medtronic announced buying Israeli startup Nutrino Health. Nutrino, founded in 2011, is a virtual nutritionist, tailor-made for one’s dietary needs, and it is commonly used to fight diabetes. The deal is expected to close in January.

To sum up – these 18 deals are worth a staggering total of more than $21 billion, which doesn’t even include the over 100 startups and companies who did not make it to this list. Although the number of deals is lower than we’ve seen in the previous years, it’s still safe to say – 2018 was a pretty good year.